Massimiliano Brion

Head of Corporate and Structured Finance Department

Graduated in Economics&Business and Corporate Finance, chartered accountant and statutory auditor, registered with the Order of Turin, he has over thirty years of experience in Corporate Finance advisory (M&A, bonds, stock market listings, structured finance), an area in which he held roles such as Head of Corporate North West Finance at UBM (Unicredit Investment Bank), Head of Origination of M&A International (now Oaklins), partner and founder of Ethica.

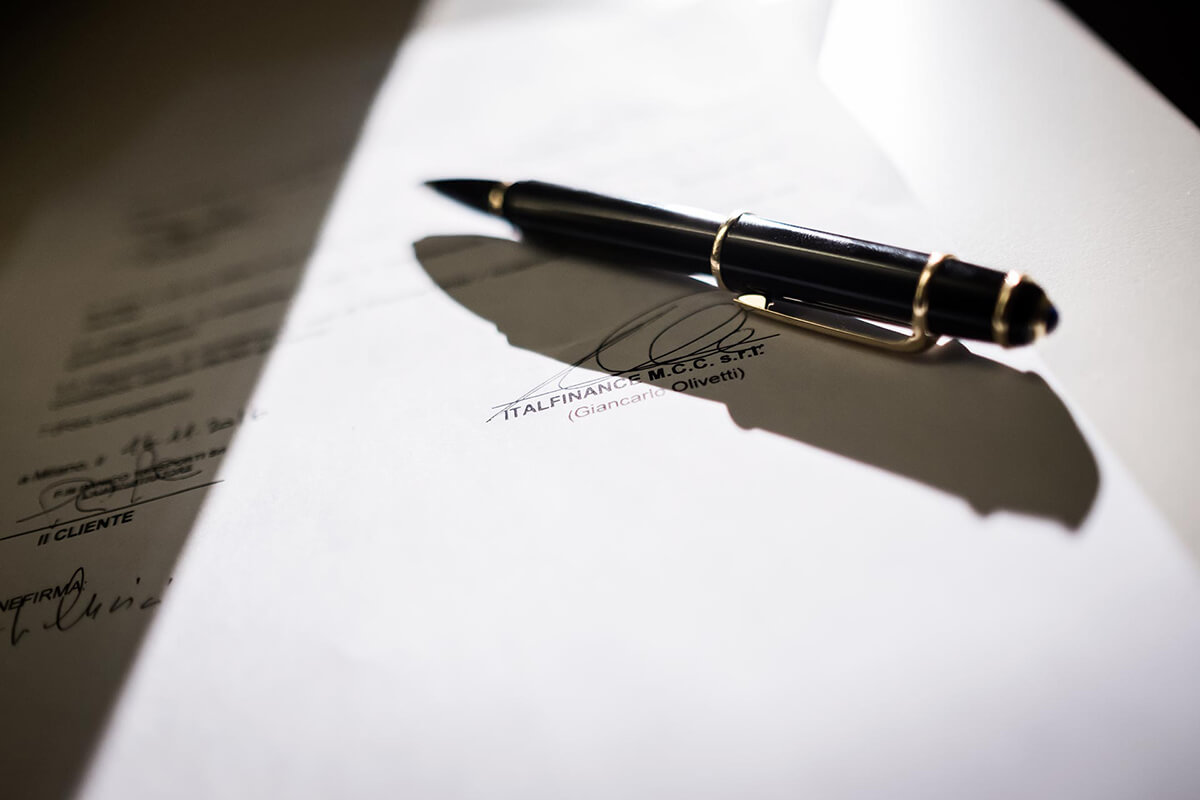

Also thanks to his consolidated relationships with the managment of the main Italian banks and with the CEOs of the main Italian debt funds, private equity funds and family offices, he is particularly involved in assisting Italfinance customers in obtaining bank loans of significant amounts at medium/long terms, structured loans (acquisition financing in support of acquisitions, project financing, leverage, family and management buy out) and in the issue of small-denomination and basket bonds (from 1 to 3 millions) and large-denomination bonds (5 millions and above).